How Mobile Payments Can Boost Growth And Profitability For Your Business?

-

Ankit Patel

- November 08, 2019

- 5 min read

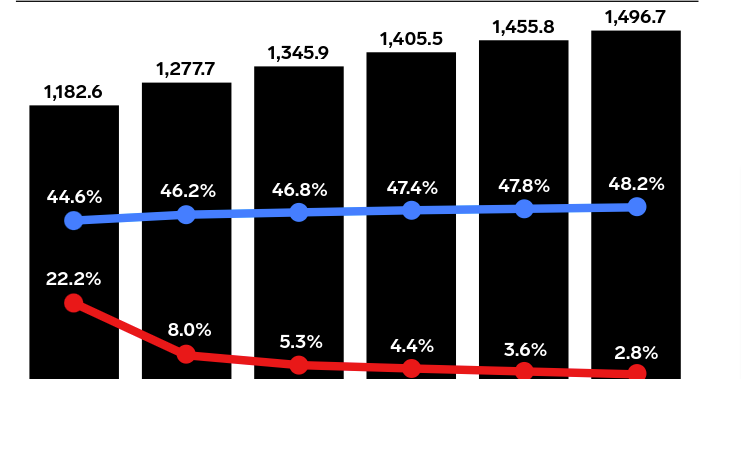

The pandemic observed the rise of many new business types, and most prominently also witnessed the popularity of many new solutions that made life easy to lead. One of those very popular solutions was mobile payments. In fact, according to predictions made by eMarketer, 48.2% of smartphone users are predicted to use their devices for making point-of-sales mobile payments.

This makes it clear that by using the option, businesses would be able to get paid in a reasonably quick manner. This will go on to enhance the overall pace of cash flow and accelerates it to the greatest extent.

As you read the lines below, you will get an idea of the factors that make mobile payment a superhero indeed for your business venture and why you need to include it within your business setup at the earliest.

Before that, we will first look at the statistics that depict the overall popular nature of mobile payments.

Statistics Depicting Popularity of Mobile Payments

Image source: emarketer.com

The graph above depicts the percentage increase that will be observed by 2025 in the number of mobile payment users. It is predicted that the numbers will witness a growth of 48.2% by 2025.

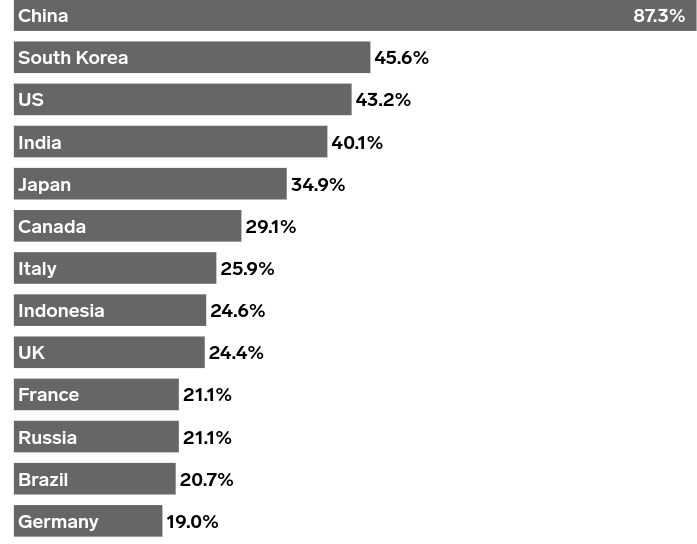

Image source: emarketer.com

In the graph above, you can observe the overall percentage of mobile payment users in countries like the ones listed above.

Now that you have an idea of the popular nature of these solutions, let us gain insight into the advantages it provides to the business in the lines below.

◉ Improved Cash Flow

Most of the electronic payments are collected within two-three days from the day when the transaction was accomplished which is comparatively much quicker than receiving payments via checks. This reduces your outstanding sales and drastically improves your business’ cash flow.

When you have plenty of cash in your hand, you can make instant payments to the parties from whom you purchase products and avail of attractive cash discounts. Also, the more money you have in your bank account, the more percentage of interest you earn on them.

◉ Less Risk

When your clients make payment for your services at that very moment, the risk of not getting paid gets reduced for the services that you have already rendered. Additionally, when you accept electronic payments, you lessen the risk of fraud and theft occurring within your business.

◉ Save Money

Other than enhancing cash flow, mobile payments through smartphones enable you to save transportation costs and your employee’s time as you need not have to send your employees to collect payments from your customers. The saved time and funds can be used in other productive activities that will in the future promote your company’s growth.

By adapting and accepting mobile payments, you can reorganize your bookkeeping and accounting systems, thereby managing cash flow in a better way. You can also save money by sending digital invoices to your customers instead of paper receipts. As the payments get transferred directly to your bank account, there will be no bank overheads and bank charges, which will again help you in saving money.

◉ Helps to Remain Competitive

During the pandemic, with the presence of mobile payments, it became easy for businesses to remain in existence. It also helped them to remain competitive. If statistics are to be relied upon, then Visa stated that the use of mobile payments grew manifold by 30%.

◉ Is Environment-Friendly

Being environment-friendly in nature, therefore when customers use the mobile payment mode for making payments, they can get the receipts of the items/services that they purchased directly on their mobile device. This is basically in the form of a text or an email. Therefore, the need for a paper receipt gets eliminated altogether.

Hence, all in all, it becomes easy to prevent incidents such as paper wastage.

◉ Track Inventory & Customer Trend

The most common difficulty almost every businessman faces is tracking the trend which his customer follows and his inventory. Now it’s easy to automate the process of tracking customer trends and inventory with the help of mobile payment systems. With these systems, you can track easily what services and products you are offering repeatedly and what is demanded the most by your customers. Mobile payment systems not only capture the payment details but also help you in meeting the demand of your customers, thereby increasing your product sales as well as boosting your business growth.

◉ Integration of Loyalties & Incentives Directly Into Mobile Payment Apps

You can directly store incentive and loyalty programs in your electronic payment apps. When your customers will use this payment app, they will discover these programs. These programs will encourage them to shop more and also provides you guaranteed retention of customers because when a customer receives more rewards from a company he will visit again and again to that company and shop there using its mobile payment services.

◉ Mobile payments Offer Complete Convenience

Contactless payments offer the most convenient dealings that can be done quickly. Almost everyone owns a Smartphone using which contactless payments can be accomplished. Putting the payment option in your customer’s palm enables them to carry out the payment procedure easily and more conveniently.

◉ Enabling Customers Pay Via Credit Cards

Earlier, small businesses operating at locations far from the city like food trucks or farmer’s markets were not able to accept payments through credit cards. As the entire transaction was carried out using cash, people with limited cash in hand were not able to buy plenty of products, which resulted in reduced sales. By implementing mobile payments systems in the business, you enable your clients to pay through credit cards. Now instead of having enough cash in hand, your clients can make bulk purchases using their credit cards which would result in an instant increase in your customer base as well as sales.

◉ Mobile Payment Systems Offer Safety

Carrying out business activities on the go accepted only cash payments. As cash is bulky, you need to store them properly otherwise it might get lost or can be stolen. Accepting mobile payments is much safer than dealing with cash transactions. With electronic payments, you can digitize your transactions and record and store them safely on your mobile devices.

Today most electronic payment systems are compatible with EMV, which means those systems make use of the most secure technology for processing credit card payments, which means that the transaction data of your customers are completely safe from Cybercrime. When your client gets assured that his every transaction data is safe, he will make purchases only from your company and will recommend others too.

◉ Enhances Customer Experience

Every single individual has given thumbs up to mobile payments. Be it buying clothes or groceries or paying electric bills, people want to make payments for them as soon as possible without standing in long queues and waiting for their turn to come to pay for the services and goods. By rendering your client’s electronic payment systems and permitting them to make payments at any time and from anywhere, you are not only offering them the best solution but also enhancing their payment experience which will result in the growth of your business.

Conclusion

Adopting mobile payment systems make it easy for your clients to carry out contactless payments using their Smartphone. Mobile payments by means of apps boost not only your business but also improve its productivity and increase customer retention. Easy & quick pay applications benefit you as well as your customers. The shopping habits of your customers can be tracked easily by you and on the basis of which you can deliver them convenient, consistent, and reliable services.

You may also like

How to Choose the Right Mobile App Development Company

-

Ankit Patel

Imagine this: you’ve got a brilliant app idea that could revolutionize your business, take it to new heights, and transform your entire customer experience. But without the right team to… Read More

How Much Does it Cost to Build a Salon Booking App like Fresha?

-

Ankit Patel

We all have witnessed the buzz in the world of beauty & wellness, and it’s booming every day thanks to the fast-paced and stressful lifestyle. In an era where time… Read More

A Complete Guide to Hotel Booking App Development With Cost

-

Ankit Patel

Whether it’s a corporate business trip or a relaxing vacation with friends, finding the right hotel at the right time and a seamless hotel booking experience is not a luxury… Read More